The EUR/USD currency pair is in a "free rise" (similar to the term "free fall"). The dollar is once again plunging into the abyss, just as we repeatedly warned. It's worth noting that the global fundamental backdrop (the part of it the market actually pays attention to) remains unfavorable for the U.S. dollar. And all the factors that could potentially support the American currency (such as central banks' monetary policies) are simply being ignored by the market.

Therefore, we are not surprised by the continued decline of the dollar. Just this week, it has lost about 250 pips, and as they say, "there's no limit to perfection." Trump wants a weak dollar, and in this regard, the U.S. president is succeeding 100%. The only question that remains is whether the collapse of the dollar is actually achieving its intended purpose.

Let us recall that the main idea behind a weak dollar is to make American exports more competitive globally. In other words, U.S. goods should be more in demand in other countries. Since the U.S. dollar has been steadily strengthening over the past 16 years, expensive U.S. exports have naturally faced low demand. However, to ensure foreign consumers buy American products, it takes more than just a weak dollar — there must also be a desire to buy American goods. And who has that desire now?

At the beginning of 2025, the entire world came to a simple realization: something is changing and not in their favor. Donald Trump deemed it a smart move to address America's trade balance problems at the expense of others. He didn't care who the "others" would be. It is now clear to everyone that these "others" are the Americans themselves, who will now face rising prices for most imported goods — particularly Chinese products, known globally for their affordability. So, Trump's primary blow was not even directed at China (though other tariff-hit countries are suffering as well) but at U.S. consumers, especially low-income ones who frequently bought from China.

Around the world, people have seen that America is imposing its trade rules without concern for fairness or fair play. A couple of months ago, entire social media campaigns emerged under slogans like "Don't Buy American!" Many consumers started rejecting American alcohol, electric vehicles, and various other goods that previously enjoyed high demand — out of principle. "You hurt us — we'll hurt you." And we don't believe the situation has changed fundamentally since then.

As such, we seriously doubt that the U.S. trade balance will improve significantly. As of May, there has not been any noticeable improvement. It's also worth noting that, aside from the deal with the UK, Trump has not signed any new trade agreements. Consequently, in two weeks, the White House will be forced to reinstate tariffs to their initial levels — and the whole cycle will begin again. This week alone, Trump stirred up fresh confusion around the Iran-Israel conflict, giving the market plenty of reasons to sell the dollar. It was just a matter of choosing which reason seemed most compelling.

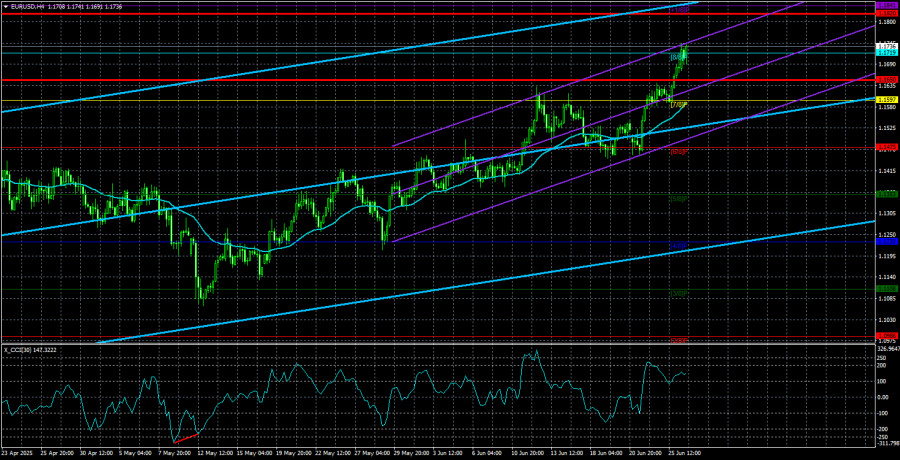

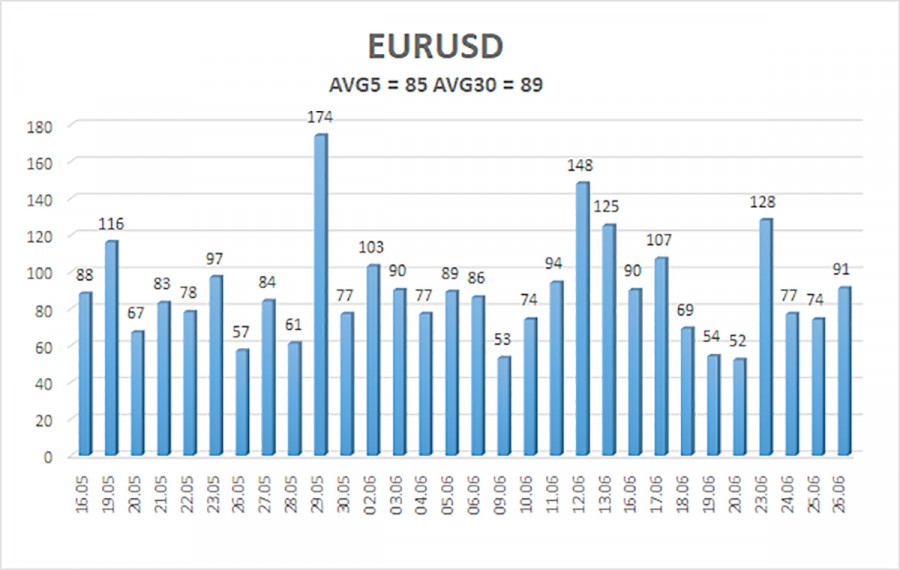

The average volatility of the EUR/USD currency pair over the past five trading days as of June 27 is 85 pips, which is considered "moderate." We expect the pair to move between 1.1650 and 1.1820 on Friday. The long-term regression channel points upward, still indicating a bullish trend. The CCI indicator entered the overbought zone, but this only triggered a minor downward correction.

Nearest Support Levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

Nearest Resistance Levels:

R1 – 1.1841

R2 – 1.1963

Trading Recommendations:

The EUR/USD pair remains in an uptrend. The U.S. dollar remains under strong pressure from Trump's policies — both foreign and domestic. Furthermore, the market either interprets most data as dollar-negative or ignores them entirely. We continue to observe a complete reluctance on the part of the market to buy the dollar under any circumstances.

If the price is below the moving average, small short positions can be considered, with targets at 1.1475 and 1.1353. However, a deep decline of the pair is unlikely under current conditions. If the price is above the moving average line, long positions remain valid, with targets at 1.1820 and 1.1841, in line with the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.