Bitcoin returned to the $121,000 mark today, but failed to hold above it. Ethereum broke through the $3,600 level.

In addition to the fact that all necessary cryptocurrency-related bills passed through the U.S. House of Representatives yesterday—sparking buying interest in Bitcoin and other assets—Donald Trump also announced his intention to open the $9 trillion U.S. pension market for investments in assets such as cryptocurrencies, gold, and private equity.

This initiative aims to increase the returns on Americans' retirement savings and ensure their long-term financial stability. The proposed step has undoubtedly provoked mixed reactions among experts.

On one hand, proponents of liberalizing the investment process point to the potential for higher returns through investments in higher-yielding assets. Given that the new legislation is already in place, there should be no major obstacles. Cryptocurrencies, for instance, despite their volatility, can generate substantial profits during periods of growth. Gold, traditionally seen as a safe-haven asset, can help protect retirement savings from inflation and economic shocks. Private equity, in turn, provides opportunities to participate in the growth of promising companies and benefit from their development.

On the other hand, critics of the initiative express concerns about the elevated risks associated with investments in non-traditional assets. Cryptocurrencies are known for their sharp price fluctuations, which can lead to substantial losses. Private equity entails long-term investments with low liquidity, making it difficult to respond quickly to changes in market conditions. Gold, although relatively stable, does not always deliver high returns.

One thing is clear: implementing Trump's proposal will require changes to existing legislation and the creation of a clear regulatory framework governing pension fund investments in alternative assets. Nevertheless, the initiative was positively received in the digital asset market.

As for the intraday crypto market strategy, I will continue to act based on any major dips in Bitcoin and Ethereum, anticipating that the medium-term bullish trend remains intact.

For short-term trading, the strategy and conditions are outlined below:

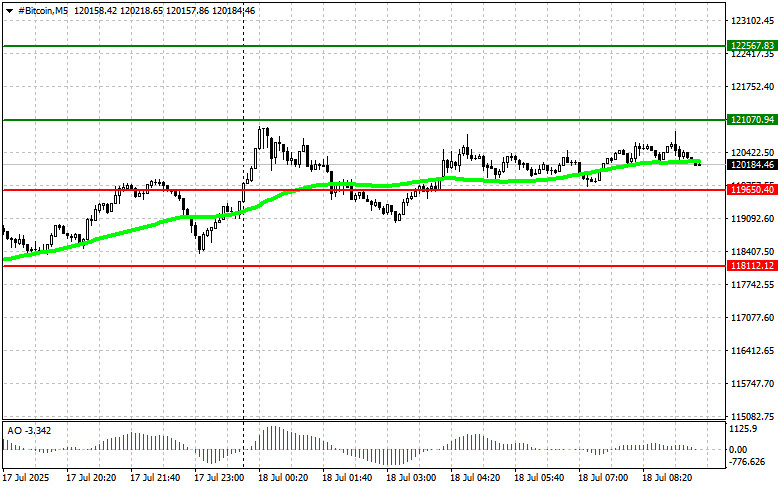

Bitcoin

Buy Scenario

Scenario #1: I plan to buy Bitcoin today upon reaching the entry point around $121,000, targeting a rise to $122,500. At around $122,500, I'll exit my long positions and sell on a pullback. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Bitcoin is also possible from the lower boundary of $119,600 if there's no market reaction to a breakout, with targets at $121,000 and $122,500.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today upon reaching the entry point around $119,600, targeting a drop to $118,100. Around $118,100, I'll exit short positions and buy on a rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Bitcoin is also possible from the upper boundary of $121,000 if there's no market reaction to a breakout, with downside targets at $119,600 and $118,100.

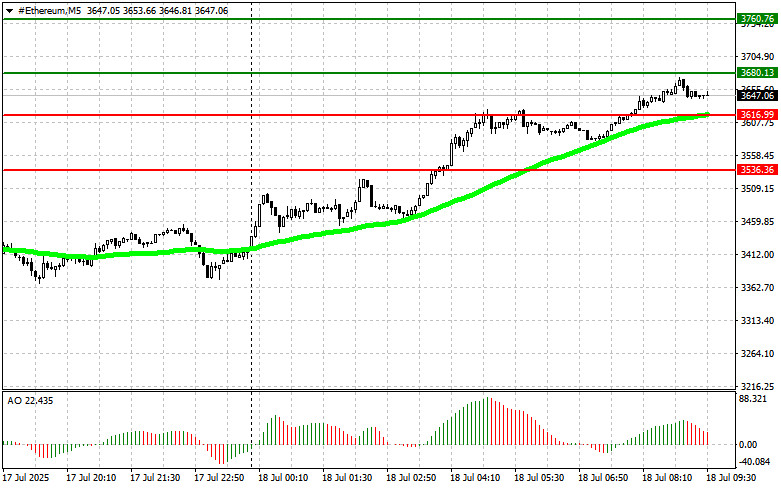

Ethereum

Buy Scenario

Scenario #1: I plan to buy Ethereum today upon reaching the entry point around $3,680, targeting a rise to $3,760. Around $3,760, I'll exit long positions and sell on a pullback. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Ethereum is also possible from the lower boundary of $3,616 if there's no market reaction to a breakout, with targets at $3,680 and $3,760.

Sell Scenario

Scenario #1: I plan to sell Ethereum today upon reaching the entry point around $3,616, targeting a drop to $3,536. Around $3,536, I'll exit short positions and buy on a rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Ethereum is also possible from the upper boundary of $3,680 if there's no market reaction to a breakout, with downside targets at $3,616 and $3,536.