The EUR/USD currency pair continued its upward movement for most of Tuesday. The dollar is collapsing like the currency of a third-world country. And the critical point is not that the U.S. economy has contracted significantly or faces bleak prospects. The real issue is that the market has been openly rebelling against Donald Trump for the fifth consecutive month. No one wants the U.S. dollar anymore. Even central banks are reducing their dollar reserves, fully aware that the "dollar era" has come to an end. The U.S. currency used to be the "world's reserve currency" and the "number one currency in the world." But now, when you hear the word "dollar," the best decision might be to run far away.

On Tuesday, it became known that the European Union is prepared to accept Trump's terms, which include a 10% flat tariff on all imports. The first thing to note is that market sentiment hasn't changed. The dollar drops on both escalation and de-escalation news regarding the trade war. Moreover, it has recently become clear that "de-escalation" is just a meaningless word. There won't be any real de-escalation. Think about it: all EU exports to the U.S. are currently subject to 10% tariffs, and after the deal, they will still be subject to a 10% tariff at best. So tariffs remain either way. Where is the de-escalation or trade truce in that?

Essentially, Trump's offer to all countries is as follows: either a deal with mild, voluntary tariffs or trade with high tariffs. But who really suffers from tariffs, and what do they mean? They mean that prices on all U.S. imports will increase, forcing American consumers to pay more. Since not everyone will tolerate the rising prices of familiar goods, some Americans will stop buying foreign products. Consequently, exporting countries will lose revenue due to reduced demand in the U.S. In short, both exporters and American consumers lose, regardless of the tariffs.

However, the EU is willing to accept a 10% tariff only if all sectoral tariffs are also reduced to 10%. This includes tariffs on steel and aluminum, pharmaceuticals, alcohol, semiconductors, and more. In other words, the EU is ready to accept tariffs, but only if a single unified rate applies to all categories of goods. Will Trump agree to that? Unknown. But what is clear is this: a fake trade truce won't save the dollar. Perhaps the U.S. economy will begin to recover in the second or third quarter, and next year a new Federal Reserve Chair will cut the key rate by 2–3%, just as Trump wants. However, the whole world now understands that dealing with the U.S. comes at a cost, and even Trump can't force anyone to use the dollar.

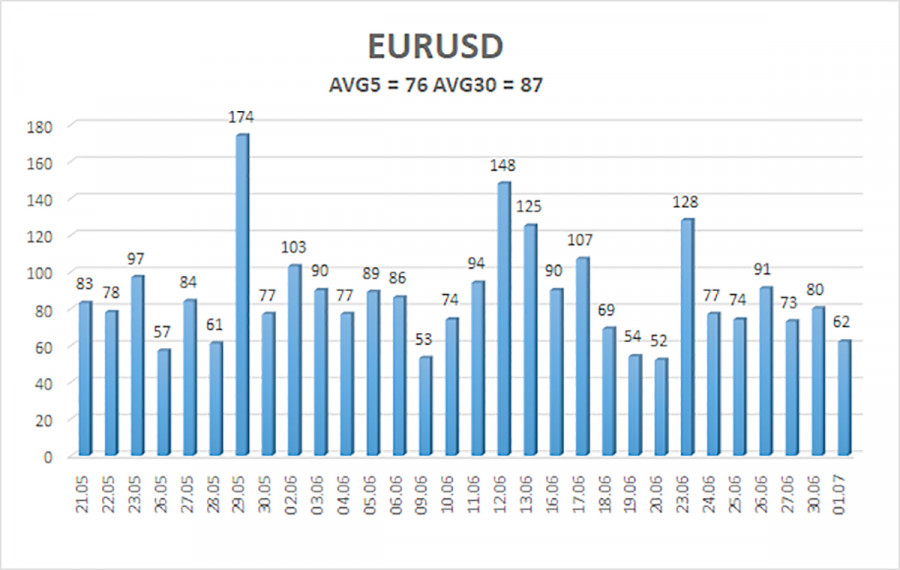

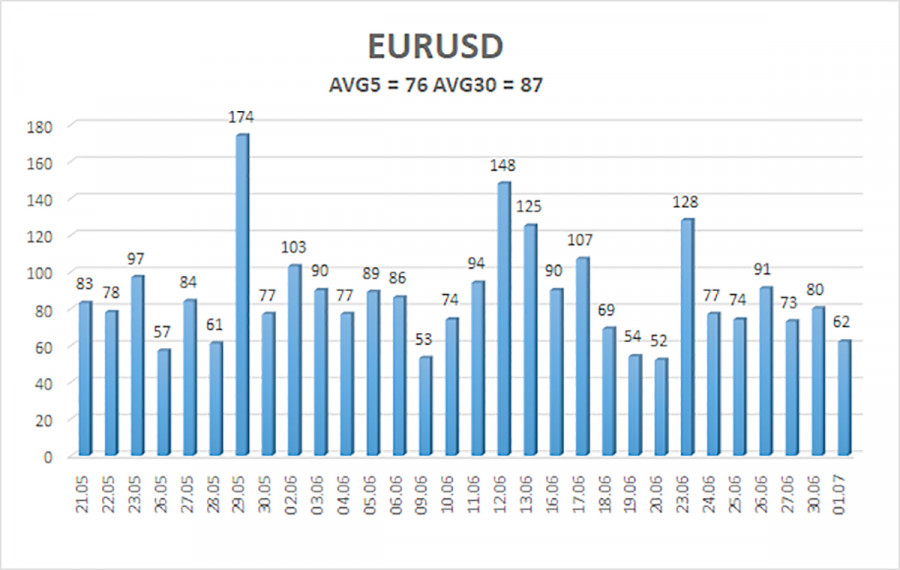

The average volatility of the EUR/USD pair over the last five trading days as of July 2 is 76 pips, which is classified as "moderate." We expect the pair to move between 1.1704 and 1.1856 on Wednesday. The long-term regression channel is pointing upward, indicating a continued bullish trend. The CCI indicator recently re-entered the overbought zone, triggering only a slight downward correction. Currently, the CCI is forming bearish divergences, which in an uptrend generally only suggest the possibility of a correction.

Nearest Support Levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

Nearest Resistance Levels:

R1 – 1.1841

R2 – 1.1963

Trading Recommendations:

The EUR/USD pair remains on an upward trend. Trump's domestic and foreign policies continue to exert significant pressure on the U.S. currency. In addition, the market often interprets or outright ignores U.S. data in ways that are unfavorable to the dollar. We continue to observe the market's complete reluctance to buy the dollar under any circumstances.

If the price is below the moving average, minor short positions toward 1.1597 may be considered, but a substantial decline is unlikely under current conditions. As long as the price remains above the moving average, long positions with targets at 1.1841 and 1.1856 remain relevant, in continuation of the bullish trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.