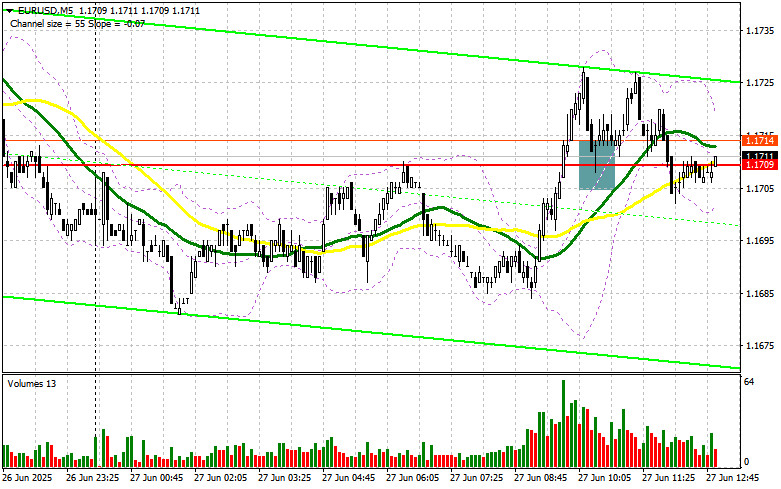

In my morning forecast, I highlighted the 1.1709 level and planned to make trading decisions based on it. Let's take a look at the 5-minute chart and analyze what happened. A breakout and subsequent retest of 1.1709 provided an entry point for buying the euro, which resulted in a 15-point upward move before bullish momentum faded. The technical outlook was revised for the second half of the day.

To Open Long Positions on EUR/USD:

French data had little impact on the pair's direction, so all attention is now on U.S. statistics. The most important release will be the Core PCE Price Index for May. If this figure rises, pressure on the euro may return, and the U.S. dollar could strengthen toward the end of the week. Other notable releases include U.S. personal income and spending data, as well as the University of Michigan Consumer Sentiment Index.

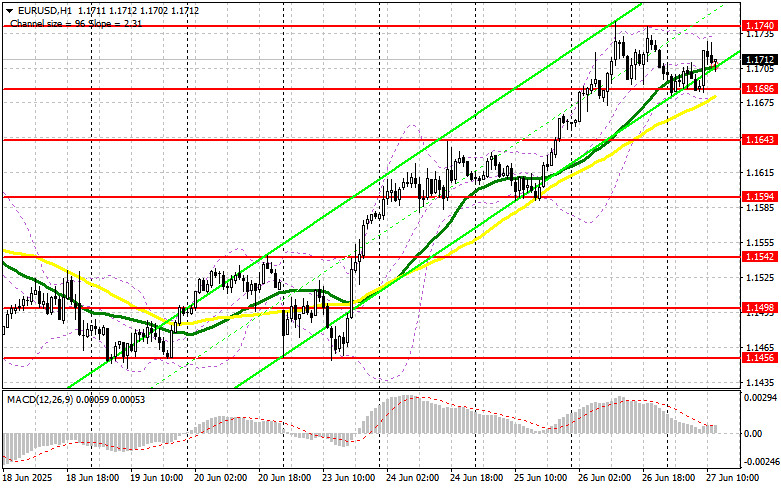

If the pair declines following the data, I will only consider buying near the new support level of 1.1686, established in the first half of the day. A false breakout at this level will be a signal to buy EUR/USD, targeting a recovery and a retest of resistance at 1.1740—the monthly high. A breakout and retest of this range would confirm a valid entry, paving the way toward 1.1775. The ultimate target will be 1.1806, where I will take profit.

If EUR/USD falls and there is no activity around 1.1686, pressure on the pair will increase significantly toward the end of the week, leading to a deeper decline. In that case, bears could push the pair down to 1.1643. I will only look to buy after a false breakout at that level. I plan to open long positions on a bounce from 1.1594, targeting a 30–35 pip intraday correction.

To Open Short Positions on EUR/USD:

Sellers remain largely on the sidelines, waiting for the U.S. inflation data. Only a sharp increase in the Core PCE Index will trigger a decline in EUR/USD. Otherwise, I plan to act only after a false breakout near 1.1740, which would serve as a signal to open short positions with a target of 1.1686—where the moving averages, currently favoring the bulls, are located. A breakout and consolidation below this range will be an opportunity to sell, aiming for a drop toward 1.1643. The ultimate downside target is 1.1594, where I will take profit.

If EUR/USD rises in the second half of the day and bears are inactive near 1.1740, buyers may push for continued bullish momentum and a move toward 1.1775. I will only sell after a failed consolidation at that level. I also plan to open short positions on a bounce from 1.1806, targeting a 30–35 point downward correction.

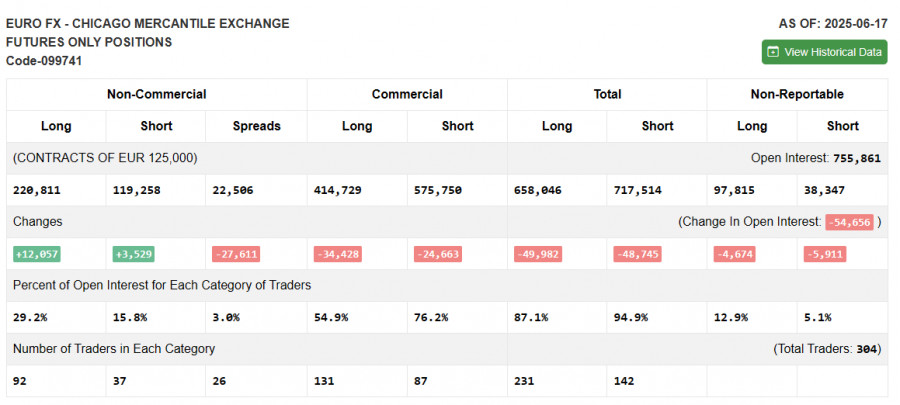

The COT (Commitment of Traders) report for June 17 showed an increase in both long and short positions. The Fed's decision to leave rates unchanged supported the U.S. dollar, but the main driver remained the conflict in the Middle East. Upcoming data on U.S. economic growth may influence the Fed's plans, which in turn will determine the direction of EUR/USD.

The COT report indicated that non-commercial long positions rose by 12,057 to 220,811, while short positions increased by 3,529 to 119,258. As a result, the gap between long and short positions narrowed by 27,611.

Indicator Signals:

Moving AveragesTrading is taking place above the 30- and 50-day moving averages, which indicates further euro strength.Note: The author evaluates moving averages on the hourly (H1) chart, which may differ from traditional daily (D1) assessments.

Bollinger BandsIn the event of a decline, the lower band near 1.1685 will act as support.

Indicator Descriptions:

- Moving Average: Smooths volatility and noise to identify the current trend.

- Period 50 – shown in yellow on the chart

- Period 30 – shown in green

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – period 12

- Slow EMA – period 26

- Signal line (SMA) – period 9

- Bollinger Bands: Measures volatility and price deviation from a moving average. Period – 20

- Non-commercial traders: Speculators like individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Non-commercial long positions: Total speculative long open interest

- Non-commercial short positions: Total speculative short open interest

- Net non-commercial position: The difference between long and short speculative positions.