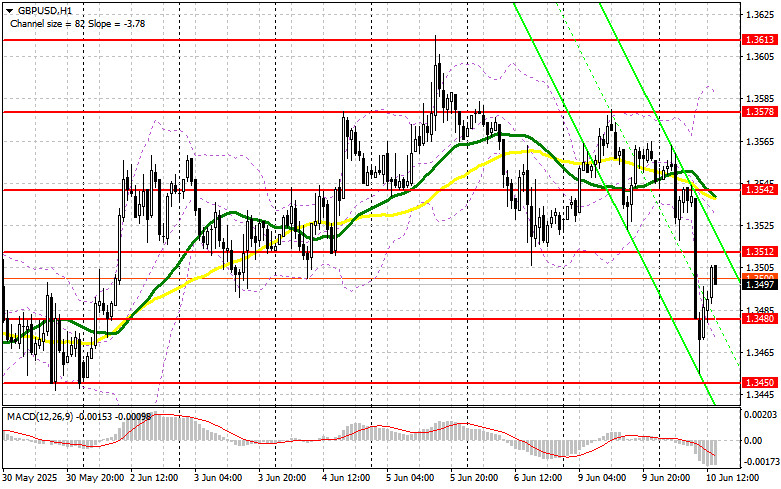

In my morning forecast, I drew attention to the 1.3545 level and planned to base market entry decisions on it. Let's look at the 5-minute chart to see what happened. A rise followed by a false breakout at that level led to a sell signal for the pound, resulting in a solid decline in the pair. The technical picture was revised for the second half of the day.

To Open Long Positions on GBP/USD:

Weak labor market data from the UK put pressure on the pound in the first half of the day. Unemployment rose, as did the number of jobless claims. In the second half, data on the NFIB Small Business Optimism Index in the U.S. is unlikely to provide much support for the dollar, giving buyers a chance for a larger correction after the sell-off.

In case of strong U.S. data, I prefer to act near the 1.3480 support level, which was formed earlier today. A false breakout there would provide a good entry point for long positions targeting a return to the 1.3512 resistance level, where trading is currently concentrated. A breakout and retest from top to bottom of this range would confirm a new long entry for a bullish continuation, with a target of 1.3542. The furthest target would be the 1.3578 level, where I will take profit.

If GBP/USD declines and bulls remain inactive around 1.3480 in the second half of the day, pressure on the pound could intensify. In that case, only a false breakout near 1.3450 would be a valid condition for opening long positions. I plan to buy GBP/USD on a rebound from the 1.3416 support level, targeting a 30–35 point intraday correction.

To Open Short Positions on GBP/USD:

Sellers did everything right today, pushing the pair out of the sideways channel. Now, it's crucial to prevent buyers from breaching above 1.3512. If GBP/USD jumps upward, I'll act after a false breakout near 1.3512, which will serve as a sell signal targeting a drop to the 1.3480 support.

A breakout and retest of this level from below will trigger stop-loss orders and open the path to 1.3450. The final target is 1.3416, where I plan to take profits. If demand for the pound returns in the second half of the day and bears remain inactive near 1.3512, a larger upward correction is likely. In that case, it's better to delay selling until a test of the 1.3542 resistance level, where moving averages currently favor sellers. I will open shorts there only on a false breakout. If there's no downward movement at that level either, I will look for shorts on a rebound from 1.3578, but only aiming for a 30–35 point intraday correction.

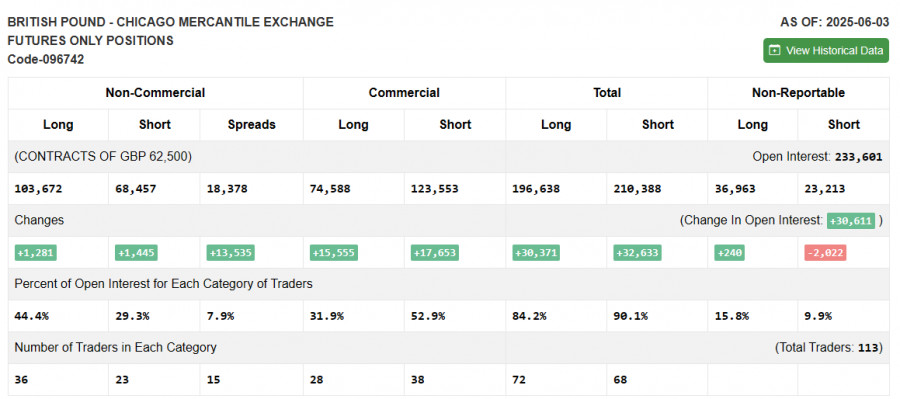

COT Report (Commitment of Traders) – June 3:

The latest report showed increases in both long and short positions, but the growth was relatively balanced and didn't lead to a shift in market sentiment. Everyone is awaiting new macroeconomic data from the UK, particularly regarding economic growth and inflation, which could significantly impact the Bank of England's plans to keep interest rates unchanged.

In addition, inflation data from the U.S. is expected this week, which may also influence market sentiment. So, there's plenty to think about. The latest COT report indicated that long non-commercial positions rose by 1,281 to 103,672, while short positions increased by 1,445 to 68,457. As a result, the gap between long and short positions widened by 13,535.

Indicator Signals:

Moving AveragesTrading is below the 30- and 50-period moving averages, which indicates continued pressure on the pound.Note: The moving average periods and price levels are based on the H1 chart and differ from classical daily MAs on the D1 timeframe.

Bollinger BandsIn the event of a decline, the lower band near 1.3470 will serve as support.

Indicator Descriptions:

- Moving Average: Smooths volatility and noise to identify trends. Period 50 (yellow), Period 30 (green)

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12, Slow EMA – period 26, Signal line SMA – period 9

- Bollinger Bands: Period 20

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes

- Long Non-commercial Positions: Total long open interest of non-commercial traders

- Short Non-commercial Positions: Total short open interest of non-commercial traders

- Net Non-commercial Position: Difference between long and short positions of non-commercial traders