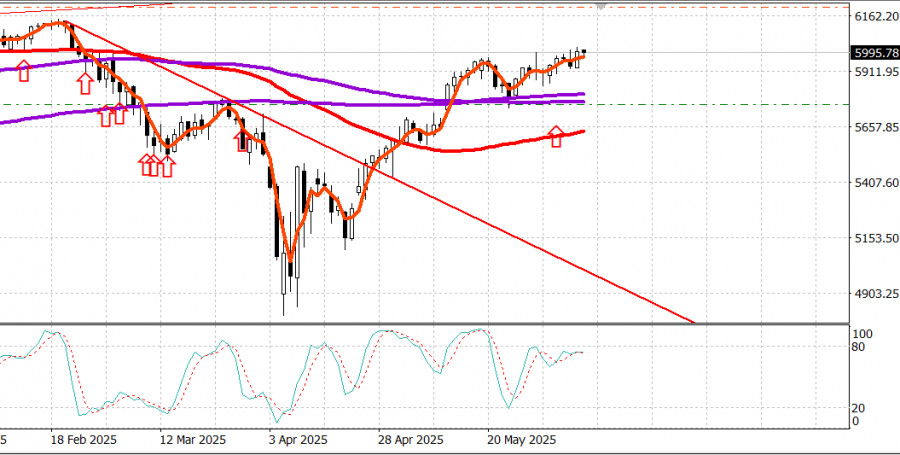

S&P 500

Overview for June 9

US market rallies on nonfarm payrolls data

Major US indices on Friday: Dow +1%, NASDAQ +1.2%, S&P 500 +1%, S&P 500: 6,000, trading range: 5,400 - 6,200.

The stock market opened Friday's session on a strong note, buoyed by a better-than-expected May employment report. It was solid enough to reinforce confidence in the idea that the US economy has a firm labor market foundation to stay on a growth path. The Treasury market got the message, too.

Yields on Treasury bonds surged following the release and remained elevated. Yields ended the day at their highs (4.04% on the 2-year, up 14 basis points, and 4.51% on the 10-year, up 12 basis points), as markets digested the view that relatively strong job figures, alongside a larger-than-expected 0.4% gain in average hourly earnings, may deter the Federal Reserve from cutting interest rates too soon.

That interpretation was echoed by the federal funds futures market. The probability of a 25-basis-point cut at the July FOMC meeting dropped to 16.5% from 31.4% the day before, while the likelihood of a similar cut in September declined to 60.6% from 73.9% yesterday.

The greenback responded in kind to the robust data and higher yields, with the US dollar index climbing 0.5% to 99.20.

Stocks, for the most part, traded in positive territory throughout the day, with the exception of select names like Lululemon Athletica (LULU 265.27, -65.51, -19.8%) and DocuSign (DOCU 75.28, -17.62, -19.0%), which were hammered following their earnings reports and guidance. Tesla (TSLA 295.58, +10.88, +3.8%) was among the best performers, rebounding from Thursday's sell-off after reports emerged that White House aides sought to arrange a phone call with Elon Musk in an effort to deescalate his intensifying feud with the president.

Later reports indicated that the president was currently not interested in speaking with Elon Musk. The US leader was preoccupied with other matters. Notably, he continued to push his case for adopting a "big beautiful budget bill," took to Truth Social to argue that the Fed should cut rates by a full percentage point, and once again turned to Truth Social to announce that his top trade negotiators, including Treasury Secretary Bessent, Commerce Secretary Lyutnik, and Trade Representative Greer, would meet with Chinese counterparts in London on Monday for trade talks.

The market digested the latest headlines calmly and closed only slightly below where it stood at the time of the announcement, holding above the 6,000 mark on the S&P 500.

In fact, the index finished the session right at that level (6,000.36), after reaching a session high of 6,016.87 shortly after the open.

Large-cap stocks led the advance, as they had throughout the week, but they had plenty of company, with all 11 S&P 500 sectors closing in positive territory.

The biggest gains came from energy (+2.0%), communication services (+1.9%), consumer discretionary (+1.6%), and financials (+1.2%).

While large-cap stocks performed well, micro- and small-cap stocks outperformed in today's risk-on session, with advancing issues outpacing decliners by more than two-to-one on both the NYSE and Nasdaq.

However, overall volume remained below average on both exchanges.

Year-to-date performance: S&P 500: +2.0% Nasdaq: +1.1% DJIA: +0.5% S&P 400: -2.2% Russell 2000: -4.4%

Economic data review:

The May jobs report easily beat the market's worst fears, as US nonfarm payrolls slightly exceeded expectations, the unemployment rate held steady at 4.2%, and average hourly earnings rose 0.4%, consistent with a solid annual pace of 3.9%.

This is a critical set of strong economic data, indicating that the economy remains on solid footing despite stock market volatility and tariff-related uncertainty.

The key takeaway is that the combination of low unemployment and a stronger-than-expected gain in average hourly earnings, following April's robust 0.8% increase in personal income, should keep consumers on a spending track and the economy on a growth trajectory.

While this report should also keep any Fed rate cuts on pause, it is one the stock market should welcome, as it reflects strong economic fundamentals that bode well for earnings prospects.

Consumer credit increased by $17.9 billion in April (consensus: $10.3 billion) after a downwardly revised decline of $3.4 billion in March (from the previously reported $10.2 billion drop). Revolving credit rose by $7.7 billion, and non-revolving credit increased by $10.2 billion.

Energy: Brent crude: $66.10. Oil holds above $65 amid US market optimism.

Conclusion: The US market is expected to extend gains.