The GBP/USD currency pair surged upward again on Monday. Just as the British pound had started a correction and even consolidated below the moving average line, Trump once again announced an increase in tariffs, and the new tension in U.S.-China relations had led traders to tone down their optimism about a trade deal between the two nations. So far, things have not progressed beyond mutual accusations. However, everything follows Trump's usual pattern—first accusations, then threats and pressure, followed by tariffs, sanctions, and restrictions. Thus, it seems likely that we'll soon see a new season of the "Trade War between China and the U.S."

Recall that last time, Washington and Beijing kept raising tariffs against each other, reaching 145% and 125%, respectively. Most experts immediately pointed out that trade between the two countries would effectively grind to a halt at such rates. Goods could be rerouted through third countries to bypass tariffs, but this would not save the entire trade flow—not even half of it. Washington and Beijing realized that further tariff increases made no sense and met in Geneva, agreeing to lower tariffs by 115%. As we can see, the peace agreement did not last long.

Now, the U.S. dollar stands a good chance of resuming its 4-month-long downward trend. What else can market participants do if there are no signs of real de-escalation? There are no trade deals, the "grace period" for 74 countries on Trump's "blacklist" will end in a month, and the U.S.-China confrontation could reignite with full force soon. In any case, the dollar only got a brief pause—and it didn't use it very well, only correcting slightly. What can we expect next if the situation does not improve?

The market continues to ignore all the factors favoring the U.S. dollar, paying no attention to the Federal Reserve's relatively hawkish stance and not worrying about the British economy, which has been mired in stagnation since the Brexit era. If these factors mattered to the market, perhaps the dollar would not have fallen so low. But right now, they mean nothing to traders.

From a technical point of view, the GBP/USD pair has once again consolidated above the moving average line, so further growth should be expected. On Monday, the UK released its manufacturing PMI for May, which turned out somewhat stronger than forecast, further helping the pound continue its upward movement. We still observe an almost unbroken uptrend on the daily time frame, and the price easily surpassed its previous high. There are still no signs of a desire to sell the pound or buy the dollar.

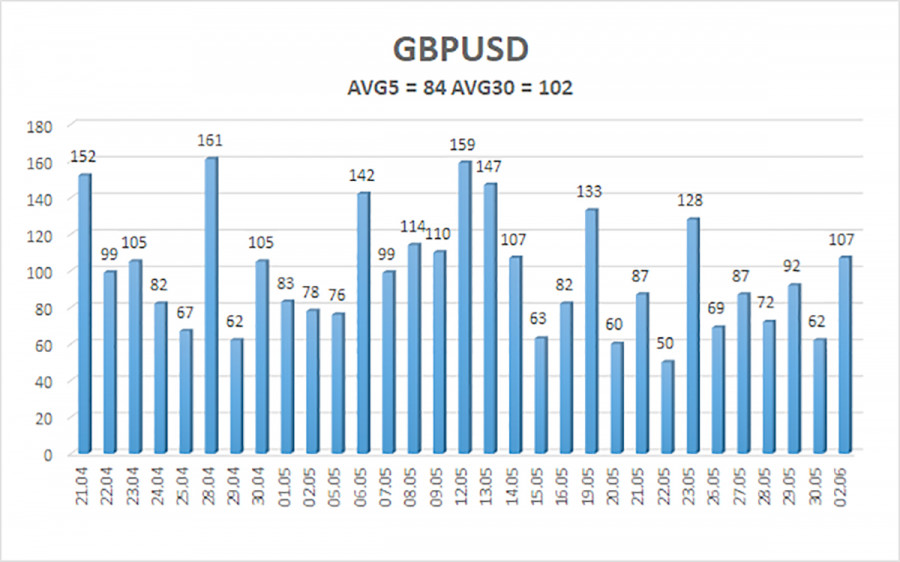

The average volatility of the GBP/USD pair over the past five trading days as of June 3 is 84 pips, which is characterized as "moderate." Therefore, on Tuesday, June 3, we expect movement from 1.3448 to 1.3616. The long-term regression channel is directed upwards, indicating a clear upward trend. The CCI indicator has not recently entered extreme zones.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Trading Recommendations:

The GBP/USD currency pair maintains its upward trend and continues to grow. There is no shortage of news supporting this movement. The de-escalation of the trade conflict started and ended quickly, but the market's aversion to the dollar remains. The market perceives every new decision from Trump or related to Trump negatively. Thus, long positions are possible with targets at 1.3616 and 1.3672 if the price remains above the moving average. A consolidation below the moving average would make it possible to consider short positions with targets at 1.3373 and 1.3306; however, who genuinely anticipates a strong dollar rally? The U.S. currency might show minor corrections from time to time. Real signs of de-escalation in the global trade war are needed for greater growth.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.