On Monday, the EUR/USD currency pair resumed its upward movement as soon as the market opened. The recent decline of the U.S. dollar last week was again caused by the same factors as before — Trump's tariffs. The situation in the currency market has now become ambiguous. On the one hand, the dollar has lost a lot in the past four months. On the other hand, there seems to be no limit to its decline. If Trump continues to pressure half the world, imposing tariffs, sanctions, and so on, the market will keep selling the dollar. At the same time, if the trade war truly starts to de-escalate, the dollar may begin to recover. Therefore, everything still depends on Trump's decisions and how the trade conflict unfolds. Predicting either of these is impossible, so traders remain hostage to circumstances.

At the end of last week, Trump once again accused the European Union of "robbing" the U.S. and promised to raise tariffs on EU imports to 50% starting June 1. However, on Monday morning, it became known that Trump had postponed his decision until July 9. According to the U.S. president, the decision followed a phone call with European Commission President Ursula von der Leyen, who allegedly asked for a delay to allow more time for negotiations. Trump told reporters that von der Leyen wants to start "serious negotiations" but needs more time.

Strangely enough, Ursula von der Leyen confirmed this information, writing on social media that Europe and the U.S. maintain the closest trade ties in the world and that the EU is ready to move decisively in the negotiations. "To reach a good deal, we need time until July 9," said the EC President. So, this time, Trump didn't change his mind; instead, he took a step toward his political opponent.

However, the market still feels a deep sense of instability and uncertainty. What prevented the European Union from being "decisive" during the previous two months? If Brussels is ready for serious talks and doesn't want a trade war, why didn't it initiate negotiations earlier? There are no answers to these questions — or many others. Let's not forget that hardly any information about the progress of negotiations has been made public. Until last Friday, it wasn't even clear whether talks with the EU were happening at all. The question remains open regarding China as well.

The current situation is not helping traders. On Friday, the market actively sold off the dollar in anticipation of another escalation in the trade war. But on Monday, it turned out the dollar should have been bought since escalation had been postponed. On one hand, the trade war continues, and confidence in the U.S. economy is eroding. On the other hand, the conflict still has a chance to de-escalate, and the U.S. economy remains the strongest in the world.

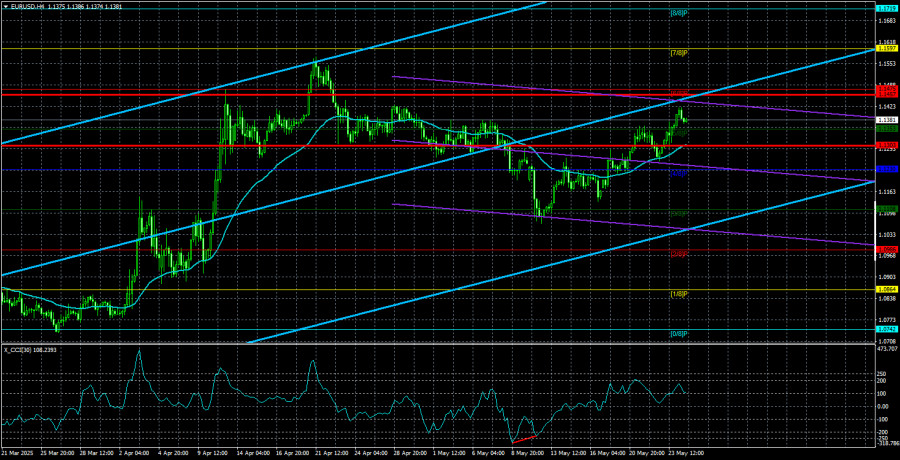

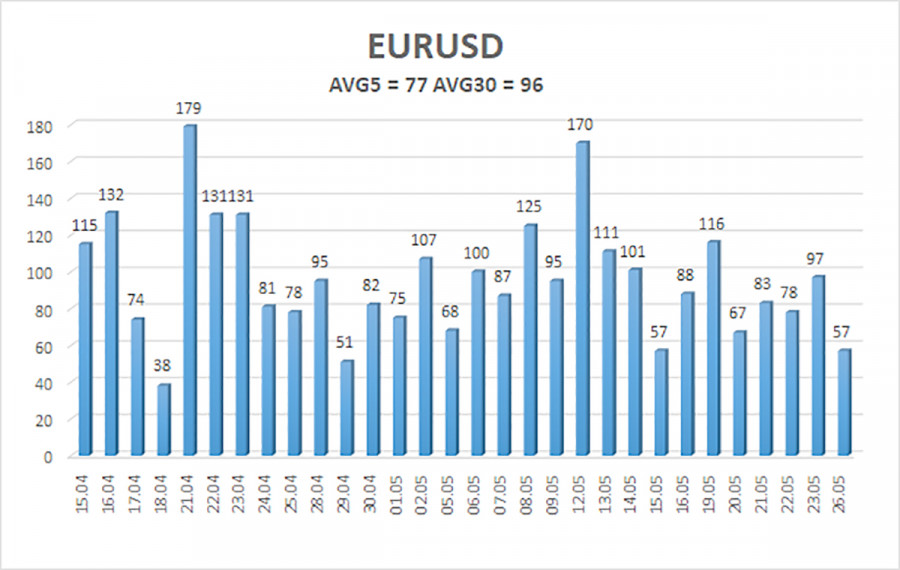

The average volatility of the EUR/USD pair over the last five trading days as of May 27 is 77 pips, which is considered "moderate." We expect the pair to move between the levels of 1.1303 and 1.1457 on Tuesday. The long-term regression channel is directed upward, still indicating a bullish trend. The CCI indicator dipped into the oversold area, and a bullish divergence formed, which, in the context of an uptrend, signals a potential continuation of the upward movement.

Nearest Support Levels:

S1 – 1.1353

S2 – 1.1230

S3 – 1.1108

Nearest Resistance Levels:

R1 – 1.1475

R2 – 1.1597

R3 – 1.1719

Trading Recommendations:

The EUR/USD pair is attempting to resume its upward trend. For several months now, we have consistently noted that we expect only a medium-term decline from the euro because the dollar still has no intrinsic reason to fall — apart from Donald Trump's policies, which will likely have destructive consequences for the U.S. economy. However, we continue to observe the market's complete unwillingness to buy the dollar, even when there are legitimate reasons to do so.

Short positions remain relevant if the price is below the moving average, with targets at 1.1230 and 1.1108. If the price is above the moving average, long positions should be considered with targets at 1.1457 and 1.1475.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.