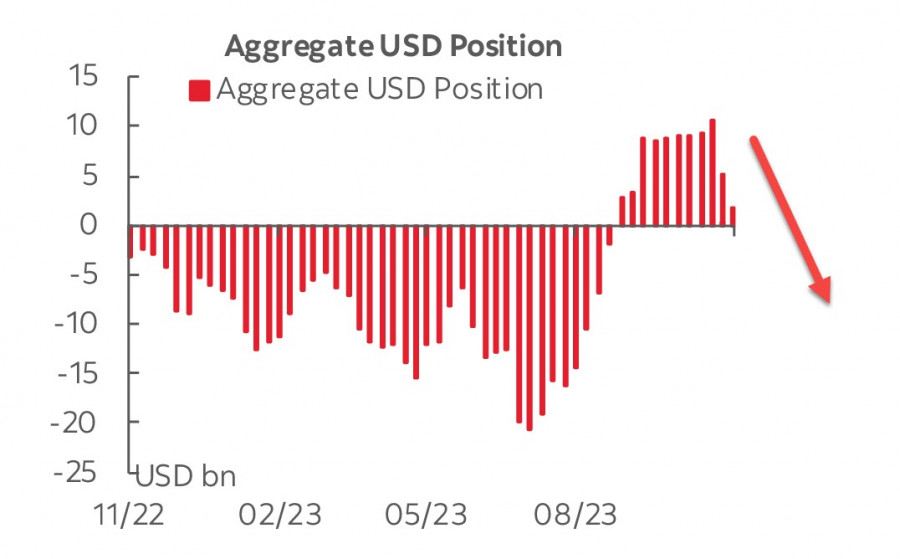

The CFTC report has confirmed the ongoing dollar sell-off. Over the reporting week, the net long position decreased by $3.4 billion, reaching $1.8 billion. The dollar was predominantly sold against the euro and the pound, with minor changes against other currencies.

We took note of the drop in the long position in oil, along with a significant increase in demand for gold. The long position in gold grew by $5.8 billion, reaching $33.7 billion. This may indicate a declining interest in risk.

In October, the PCE inflation came in below expectations, standing at 3% YoY (compared to 3.4% in September). The core component, inflation in the services sector, slowed down both on a monthly and yearly basis. This outcome further increased the likelihood of an early start to the Federal Reserve's rate cut cycle, with the market now estimating around a 60% probability of the first cut taking place at the March 20 meeting. Understandably, such news does not help in making the dollar more stable.

Oil futures sharply declined on Friday amid reports that OPEC+ decided not to reduce production quotas.

The ISM Manufacturing PMI index in the U.S. remained unchanged in November, staying in contraction territory at 46.7. The U.S. is set to release several important reports this week, including the ISM in the services sector, employment reports, and inflation expectations from the University of Michigan.

The recent dollar sell-off has been driven by objective factors, including inflation slowdown and changes in rate forecasts. However, a slowdown in eurozone inflation could reignite interest in the dollar, as, fundamentally, U.S. economic growth appears more favorable, potentially prompting inflows into stock markets.

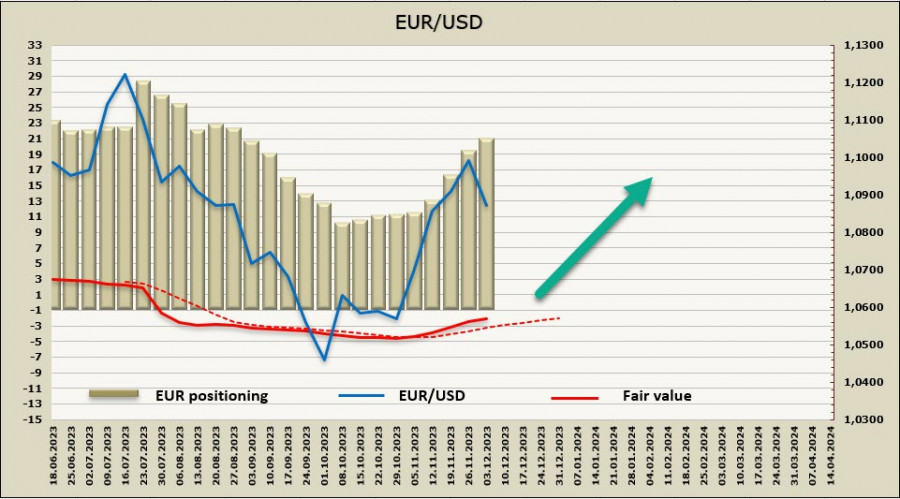

EUR/USD

Eurozone inflation fell much more than expected, dropping to 2.4% in November (forecast 2.7%) from 2.9% the previous month. Core inflation decreased from 4.2% to 3.6%. Markets reacted with an increased probability that the European Central Bank will cut rates to 2.75% by December 2024, representing a total reduction of 1.25%. This significant shift reduces the chances of the euro rallying against the dollar by the end of December.

Sentix's economic expectations for the eurozone increased by 0.2 points for the third consecutive time but remained negative at -9.8 points, with the overall index rising to -16.8 points. While this is the best value since May, it is unclear if it signals a trend reversal towards positivity. There are no signs of growth in any region of the eurozone, and Germany is at the bottom of the rankings. Positive indicators include improvements in inflation forecasts, with the sub-index rising for the fifth consecutive month.

The net long EUR position increased by 1.9 billion to 19.7 billion over the reporting week, the highest since September, indicating bullish speculative positioning. The price is above the long-term average and is headed upward.

The euro fell slightly short of the target set the previous week at 1.1030/50, but the chances of further growth remain high. Support comes from the lower band of the channel at 1.0820/30, a decline to which could trigger new purchases, followed by the technical level of 1.0800. The nearest target is the recent high at 1.1018, with a good chance of an update, followed by 1.1070/80.

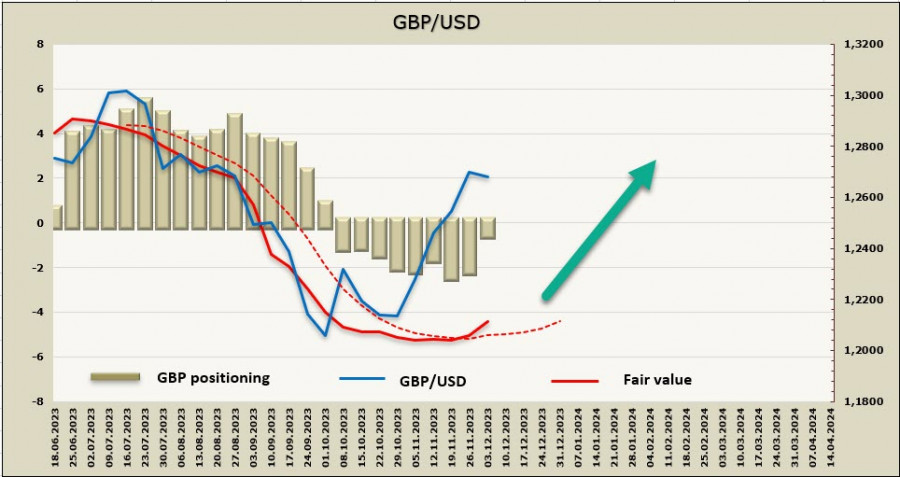

GBP/USD

The Manufacturing PMI data in November turned out to be better than expected, with a clear slowdown in activity. However, it is far from being in positive territory, marked by a sharp decline in exports and new orders, reduction in staff, and purchases. New orders have been decreasing for eight consecutive months, while export orders have been declining for 22 months.

Certainly, the manufacturing sector in the United Kingdom constitutes only a small part of the economy, but regardless, it's too early to talk about the possibility of a sustainable economic recovery.

The net short GBP position is close to liquidation, having decreased by 1.5 billion to -0.6 billion over the week. The positioning is currently neutral, but the trend is leaning in favor of the pound. The price is moving upward.

The pound continue to rise, reaching the technical level of 1.2718, but it couldn't settle above it. Support is at 1.2570/90, and after a brief consolidation, we expect the pound to make an attempt to move higher, with 1.2790/2820 as the target.