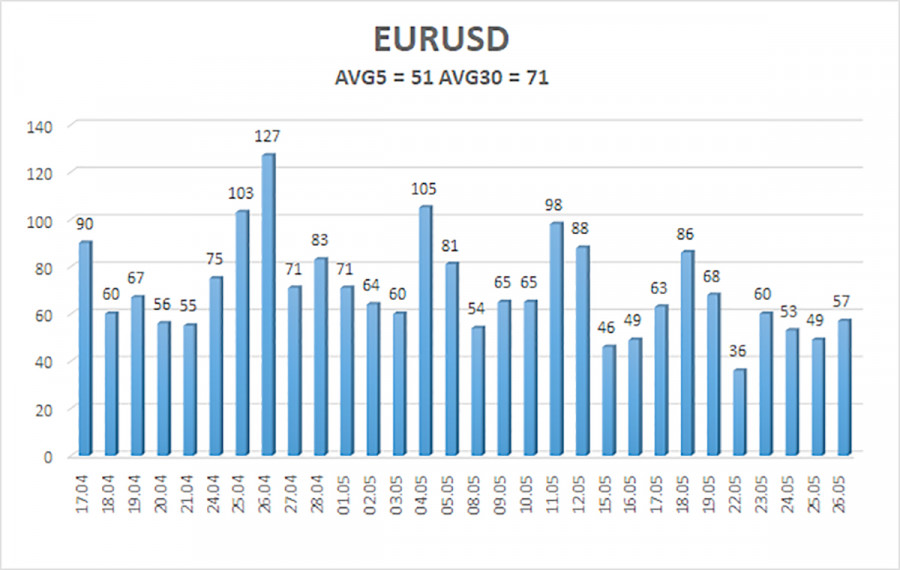

At the moment, a paradoxical situation has developed in the market. We have a clear and strong downward trend, but the pair moves only 50-60 pips per day, decreasing by approximately 20 pips daily. On the one hand, we have a strong trend, but on the other hand, we have weak intraday price changes. Therefore, trading intraday at the moment could be more practical and effective.

For example, within the strongest swing on Friday, the pair declined by 50 points. This happened at the beginning of the American trading session when reports started to be published. How should we interpret such a movement? On the one hand, it was a sharp drop in line with the current average volatility, but on the other hand, how much can you earn from a 50-pip movement, considering that it is not possible to open and close a trade at extremes? Therefore, trading at the moment only makes sense in a medium-term style, that is, holding a trade open for several days or weeks. Fast indicators like Heiken Ashi should be considered as they frequently change direction.

Overall, we have a confident decline in the euro and a rise in the dollar, fully consistent with our forecasts. The pair's decline should continue regardless of the fundamental and macroeconomic background, as the pair is still too overheated. Last week they partly confirmed our conclusions, as there were no blatantly negative reports or news for the euro currency.

There will be a lot of important statistics.

There will be several important reports and events during the last week of May and simultaneously the first week of June. They will start to be published on Wednesday, and Monday traditionally may become a "semi-holiday." Germany will release unemployment rate and inflation data. It is worth noting that Germany is just one of the 27 EU countries, but it is still the largest economy in the European Union, so the inflation report may interest traders. On the same day, ECB President Christine Lagarde will give a speech. We expect little from this event since even the new inflation report for the EU will still need to be released, and Ms. Lagarde has already made multiple appearances over the past two weeks.

On Thursday, the inflation report for the European Union will be published. According to forecasts, the consumer price index may drop from 7% to 6.3-6.5%, which can be considered a significant slowdown. If the forecast materializes, it will further reduce the likelihood of further monetary policy tightening. Currently, the market is factoring in two more rate hikes of 0.25%. Immediately after the report, Christine Lagarde will give another speech, which may be more interesting to traders as the inflation report will already be known.

The euro currency may continue to decline in the coming week. If inflation continues to decline in the European Union, there will be no "hawkish" statements from Christine Lagarde, and the aggressiveness of ECB representatives regarding rates will diminish. Thus, the euro currency will need more grounds for growth. Of course, more statistics from across the ocean could negatively impact the US currency, but we will discuss that in the GBP/USD article.

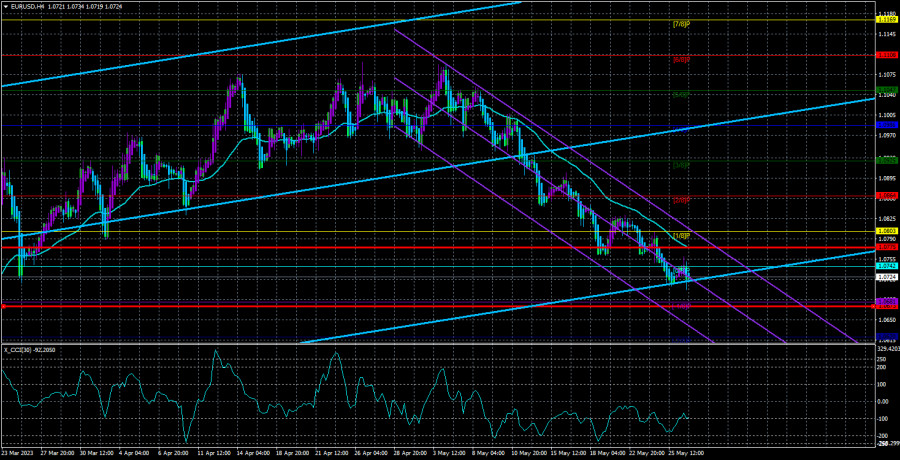

In summary, we still don't see significant reasons for strengthening the euro currency. If the US government debt situation does not resolve itself best, demand for the US currency may decrease. Still, the absolute majority of factors currently continue to support the dollar. The CCI indicator on the 4-hour timeframe has not entered the oversold zone, so we currently have no signals to buy.

The average volatility of the euro/dollar currency pair over the last five trading days as of May 27 is 51 pips, characterized as "average." Therefore, we expect the pair to move between the levels of 1.0673 and 1.0775 on Monday. A reversal of the Heiken Ashi indicator upwards will indicate a new wave of corrective movement.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0863

Trading recommendations:

The EUR/USD pair continues its downward movement. It is advisable to remain in short positions with targets at 1.0681 and 1.0673 until the price consolidates above the moving average. Long positions will become relevant only after the price is confirmed above the moving average line with a target of 1.0864.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

Moving average line (settings 20, 0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will move in the next 24 hours, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates an approaching trend reversal in the opposite direction.