Long-term outlook

Throughout the current week, the EUR/USD currency pair's trading was flat. Also, we are discussing the flat in terms of both the junior TFs and the most senior TF. Currently, there is no apparent trend on the 24-hour TF, thus the Ichimoku indicator's lines are essentially meaningless. Officially, the pair is still fixed below the Ichimoku cloud, allowing us to anticipate that the decline will continue, but in reality, this consolidation is meaningless. Although it might take some time, we still think that the European currency is significantly overbought and should continue to move south. The option of a long-term downward correction has not yet been canceled. Yet, the implementation is delayed.

During the reporting week, at least two significant events for the euro occurred. Initially, the ECB had its second meeting of the year. Second, the February inflation report was released. Now, however, it is clear that neither of these events exceeded our expectations. No decisions were made by the ECB, and Christine Lagarde's comments at the press conference held following the meeting were modest and conflicting. Lagarde stated that the key rate will continue to grow on the one hand. On the other hand, she added that the ECB will respond right away, depending on what happens. This indicates that the rate will change (increase) in response to new information regarding the GDP, the labor market, and inflation. Theoretically, the change in Lagarde's rhetoric has no bearing on the key rate, because inflation remains excessively high, implying that the ECB should continue to raise rates as quickly as possible. The economy is in a pre-recessionary position but has not yet entered it. And it is because of this factor that the ECB will probably cut down the pace of tightening monetary policy. This reality is negative for the euro since starting with the next meeting, both the Fed and the ECB will increase interest rates at the same rate, but the Fed rate has been and will continue to be higher. Thus, we think that the value of the euro should keep declining.

COT Analysis

A new COT report for March 7 was made public on Friday. The CFTC publishes reports at a frequency of every two weeks as it works to make up for the lost time. If things continue, we will resume receiving current data in a few weeks. Thus far, we can claim that the picture accurately reflects what has been happening in the market during the past few months. The aforementioned illustration unequivocally demonstrates that since the start of September 2022, the net position of significant players (the second indicator) has been improving. At about the same time, the value of the euro started to increase. The net position of non-commercial traders is currently "bullish" and has only recently started to slowly start declining, which correlates with the decline of the euro currency. We have already called traders' attention to the fact that a relatively large value of the "net position" leads us to expect the rally to stop shortly. This is indicated by the first indicator, which frequently occurs before the end of a trend and on which the red and green lines are quite far apart. Although the euro has already started to decline, it is still unclear whether this is just a minor pullback or the beginning of a new downward trend. The number of buy contracts from the non-commercial group declined by 6,900 during the most recent reporting week, while the number of short contracts grew by 6,900. As a result, the net position decreased by 13,800 contracts. For non-commercial traders, there are 148 thousand more buy contracts than sell contracts, or nearly three times as many. In any case, the correction has been building for a while, so the pair should keep falling even in the absence of COT reports.

Analysis of important events

The ECB meeting was meant to be the major event this week, but it was delayed. The report on European inflation came in second in terms of relevance, but as its value was exactly in line with the projection, there was no particular market reaction. Once this news was published, the euro fell by 40 points, but who cares about 40 points right now? 8.5% y/y inflation is considerably more significant. A very slight 0.1% yearly decrease in price increase is shown by this data. Even more intriguing was the core inflation measure, which increased from 5.3% to 5.6% and has never in principle indicated a slowdown. The only choice left to the ECB is to keep raising the key rate. And from our perspective, they should do it at the highest rate possible — not less than 0.5%. If "hawkish" sentiment begins to wane in May, this could be negative for the euro.

Trading strategy for the week of March 20–24:

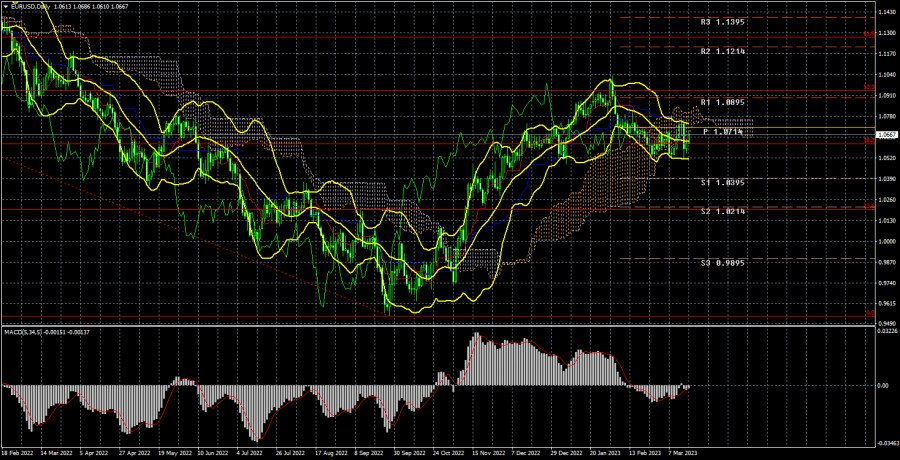

1) The pair remains in a downward trend in the 24-hour timeframe and is still situated below the Kijun-sen and Senkou Span B lines. If not for the flat and "swing," the fall may thus continue with targets in the range of 1.0200-1.0300. Although we still think sales are appropriate, the market has recently been unable to decide what to do with the pair.

2) The purchases of the euro/dollar pair are no longer significant. So, you need at least wait for the price to return above the critical Ichimoku indication lines before thinking about going long. There are now no circumstances under which the medium-term growth of the euro currency is possible.

Explanations for the illustrations: Fibonacci levels, which serve as targets for the beginning of purchases or sales, and price levels of support and resistance (resistance/support). Take Profit levels may be positioned close by;

Ichimoku indicators (standard settings), Bollinger bands (standard settings), and MACD (5, 34, 5);

The net position size of each trading category is represented by COT chart indicator 1;

The net position size for the "Non-commercial" category is shown by indicator 2 on the COT charts.