The GBP/USD currency pair rose 280 pips between Wednesday and Thursday, only to crash by 340 on Friday. These kinds of "flights" have become a regular occurrence lately. While the dollar's collapse after Trump's introduction of new, sweeping tariffs can be easily explained, the sharp dollar rally on Friday is more challenging to understand. That said, there were indeed strong drivers behind the dollar's rebound.

First, the Nonfarm Payrolls report showed the creation of 228,000 new jobs, significantly above the 135,000 forecasts. Second, Jerome Powell reiterated on Friday that the U.S. president can impose any tariffs or sanctions — none of that matters to the Federal Reserve. The central bank is only interested in the consequences of those actions: their impact on the economy, inflation, and labor market. Once those effects are clearer, the Fed will respond.

Third, Powell again made it clear that an economic downturn is not the Fed's problem—especially if it's not caused by monetary policy. Let us reiterate: if a recession does hit the U.S., it will be attributed to one man—Donald Trump. No one will think of blaming the Fed. Powell doesn't want to be responsible for the consequences of the president's actions, which most of the world condemns.

To summarize, there were reasons for the dollar rallying on Friday. However, in recent months, market participants have routinely ignored dollar-supportive data. And Powell's Friday message wasn't anything new — he's been repeating for months that the Fed is in no rush to ease monetary policy. We still believe that if inflation in the U.S. continues to rise (which seems highly likely), the Fed might abandon the idea of easing altogether in 2025. The Fed's hawkish tone hasn't mattered to traders recently, so there's little reason to believe it will suddenly spark a significant dollar rally now.

What can we say about the currency market and private traders if Powell sees high economic uncertainty? How can everyday traders predict currency movements if the Fed Chair can't forecast key macro indicators for the coming months?

It's also worth remembering that while Trump pushes his trade agenda, the European Union isn't planning to accept the new trade reality in silence. Retaliatory tariffs on the U.S. may be introduced as soon as next week. Trump, in turn, might respond with tariffs on the retaliatory tariffs. In our view, the global trade war will only escalate further soon. In such a fundamentally political and trade-driven environment, predicting currency movements becomes nearly impossible.

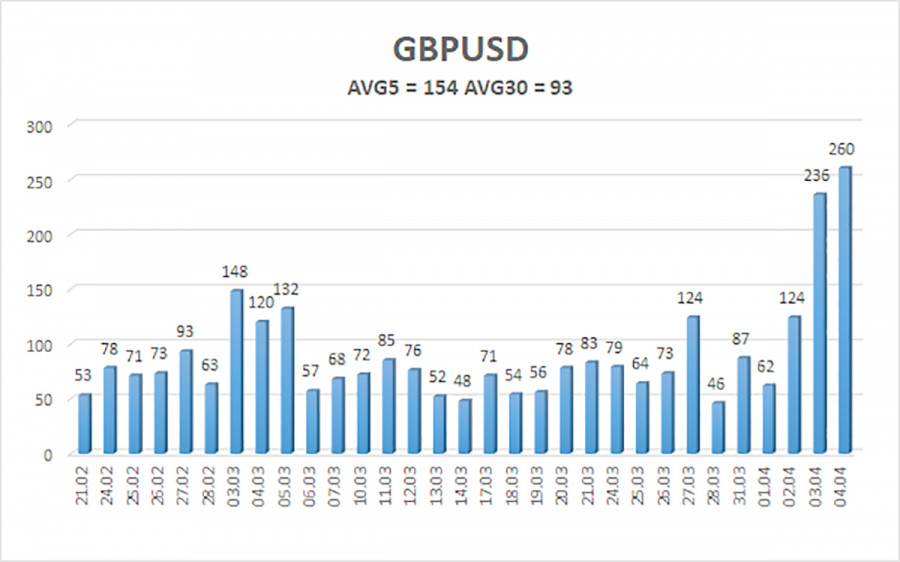

The average volatility of the GBP/USD pair over the past five trading days is 154 pips, which is considered "high" for this pair. On Monday, April 7, we expect the pair to move from 1.2741 to 1.3049. The long-term regression channel is pointed upward, but the downtrend remains intact on the daily time frame. The CCI indicator entered the overbought zone, signaling a corrective pullback, which has begun swiftly.

Nearest Support Levels:

S1 – 1.2817

S2 – 1.2695

S3 – 1.2573

Nearest Resistance Levels:

R1 – 1.2939

R2 – 1.3062

R3 – 1.3184

Trading Recommendations:

The GBP/USD pair has entered a sharp decline that may evolve into a prolonged correction — at the very least, a correction. We still do not consider long positions valid at this stage, as the current upward movement looks like a disjointed correction on the daily time frame. However, if you trade purely on technical signals, long positions remain relevant with a target of 1.3184, provided the price holds above the moving average. The pound could continue to rise if Trump keeps imposing tariffs and other countries introduce retaliatory measures. Short positions remain attractive with targets at 1.2207 and 1.2146 because the upward correction on the daily chart will eventually end — unless the broader downtrend ends first. Even if we are witnessing the beginning of a new uptrend, a downward correction is needed, as the pound has risen far too sharply in recent weeks.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.