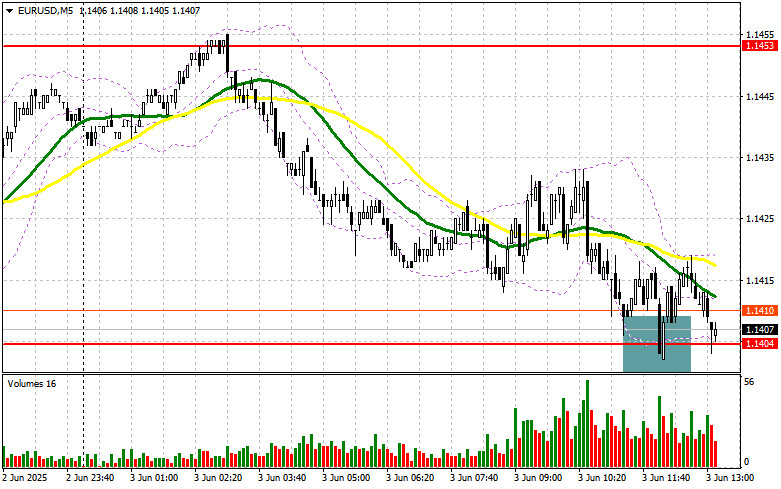

In my morning forecast, I pointed out the 1.1404 level and planned to base trading decisions around it. Let's look at the 5-minute chart and see what happened. A decline and a false breakout around 1.1404 led to a buying entry for the euro, but as you can see on the chart, the pair didn't achieve significant growth. The technical outlook for the second half of the day remained unchanged.

Requirements for Opening Long Positions on EUR/USD:

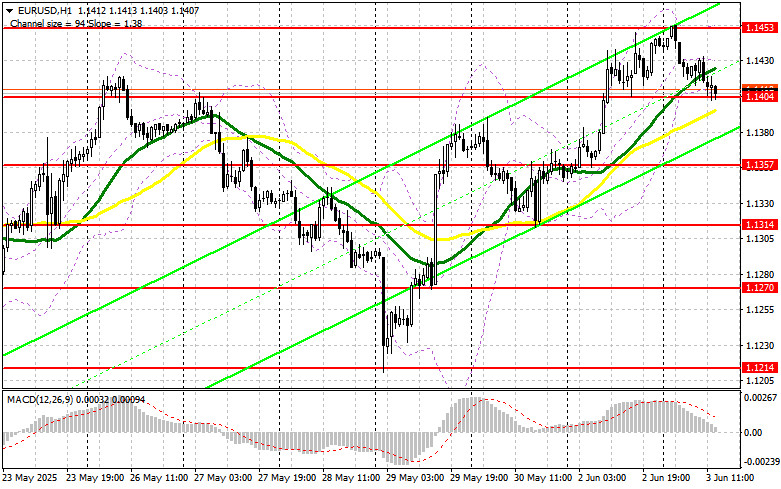

Inflation in the Eurozone slowed to 1.9%, while economists expected it to be 2.0%. This allows the ECB to continue acting relatively dovishly, leaving room for another rate cut later this summer. This is rather negative for the euro's upward prospects. In the second half of the day, we await the JOLTS job openings data and U.S. factory orders report. There will also be speeches by FOMC members Austan D. Goolsbee and Lorie K. Logan. If the pair declines, focus will shift to defending the 1.1404 support level, formed based on yesterday's results. A false breakout there, similar to the pattern discussed earlier, would serve as a signal to buy EUR/USD in anticipation of a new monthly high around 1.1453. A breakout and retest of this range will confirm the correct entry point, with the next target at 1.1490. The final target will be the 1.1530 level, where I plan to take profit. If EUR/USD declines and there's no activity around 1.1404, the pair will come under pressure again, potentially leading to a sharper drop. Bears could then reach 1.1357. Only after a false breakout form will I consider buying the euro. If the price continues to fall, I plan to open long positions immediately from 1.1314, targeting an intraday upward correction of 30–35 points.

Requirements for Opening Short Positions on EUR/USD:

If the euro rises in the second half of the day following the data, only Fed members' comments could harm the bullish market. Thus, it's better to wait for a false breakout around the 1.1453 resistance area, which was updated during today's Asian session. This would serve as a signal for short positions, aiming for a decline toward the 1.1404 support, where moving averages are favoring the bulls. A breakout and consolidation below this range will offer a suitable sell opportunity, pushing the pair toward 1.1357. The final target will be the 1.1314 level, where I plan to take profit. If EUR/USD continues rising in the second half of the day and bears show no activity around 1.1453, buyers could achieve a larger rally and a renewal of the 1.1490 level. I will consider selling only after an unsuccessful consolidation there. I also plan to open short positions immediately from 1.1530, targeting a downward correction of 30–35 points.

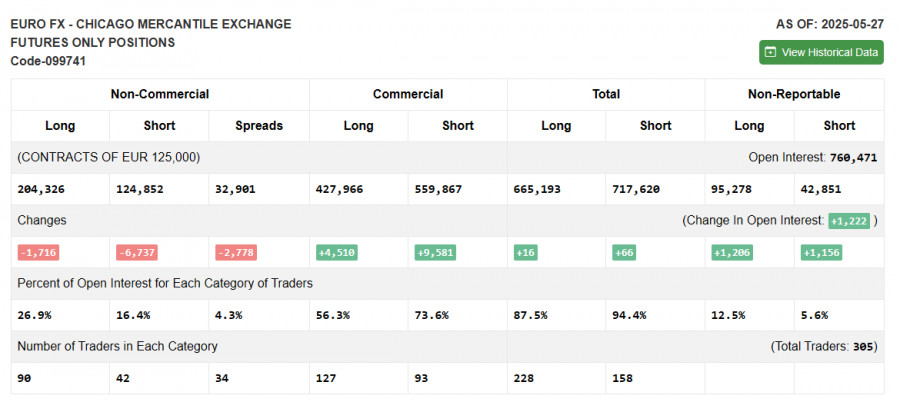

COT Report (Commitment of Traders) as of May 27:

The COT report showed a decrease in both long and short positions. However, buyers still maintain the advantage. Traders are preparing for the upcoming ECB meeting, where another rate cut is expected. Many economists also suggest this will be the last cut before the regulator takes a prolonged pause in this cycle, which could support the euro in the short term. Add to this the upcoming GDP report and U.S. labor market data, and the week promises to be quite intense. According to the COT report, long non-commercial positions declined by 1,716 to 204,326, while short non-commercial positions dropped by 6,737 to 124,852. As a result, the gap between long and short positions narrowed by 2,778.

Indicator Signals:

Moving Averages Trading is conducted above the 30- and 50-period moving averages, indicating further potential for the pair's growth.

Note: The period and price of the moving averages considered by the author are based on the H1 chart and differ from the classic daily moving averages on the D1 chart.

Bollinger Bands In the event of a decline, the lower band of the indicator around 1.1404 will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing out volatility and noise. 50-period, marked in yellow on the chart.

- Moving Average: 30-period, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – 12-period, Slow EMA – 26-period, SMA – 9-period.

- Bollinger Bands: 20-period.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total long open positions of non-commercial traders.

- Short non-commercial positions: Total short open positions of non-commercial traders.

- Net non-commercial position: The difference between the short and long positions of non-commercial traders.