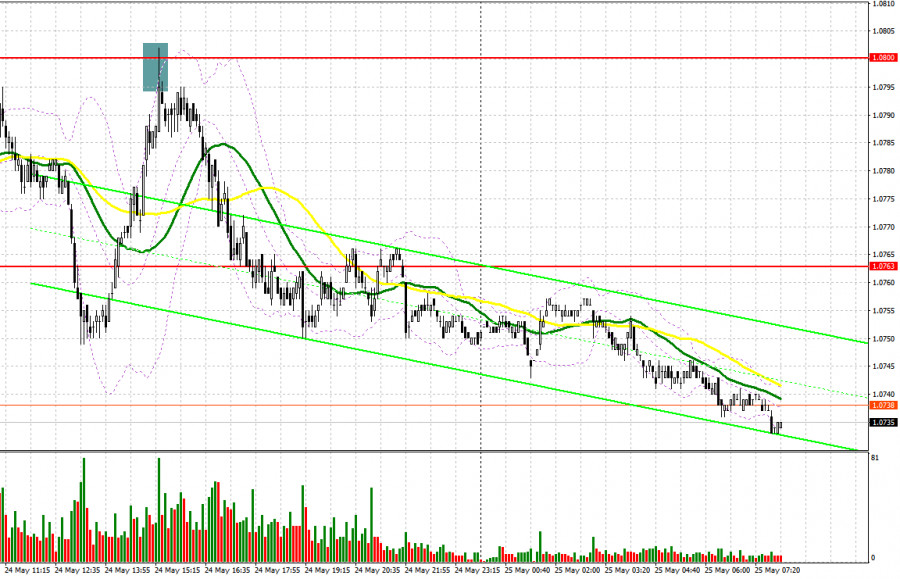

Yesterday, there was only one signal to enter the market. Let's have a look at the 5-minute chart and see what happened there. In my morning review, I mentioned the level of 1.0762 as a possible entry point. A breakout of this mark took place, but I didn't wait for the reverse test. Because of this, it was impossible to get the appropriate signals. In the second half of the day, a false breakout at 1.0800 provided an excellent sell signal. As a result, the pair fell by 50 pips.

For long positions on EUR/USD:

Factors like the US credit rating at risk for downgrade and lack of progress in negotiations to raise the US debt limit had quite a strong impact on the euro, which kept the demand for safe-haven assets and led to another EUR/USD sell-off. This morning we are expecting the German GDP report as well as the leading consumer climate index. The figures may turn out to be quite unsatisfactory, so I expect the pressure to persist. The speeches of European Central Bank Vice President Luis de Guindos and ECB board member Joachim Nagel will also be quite interesting and may influence the market direction.

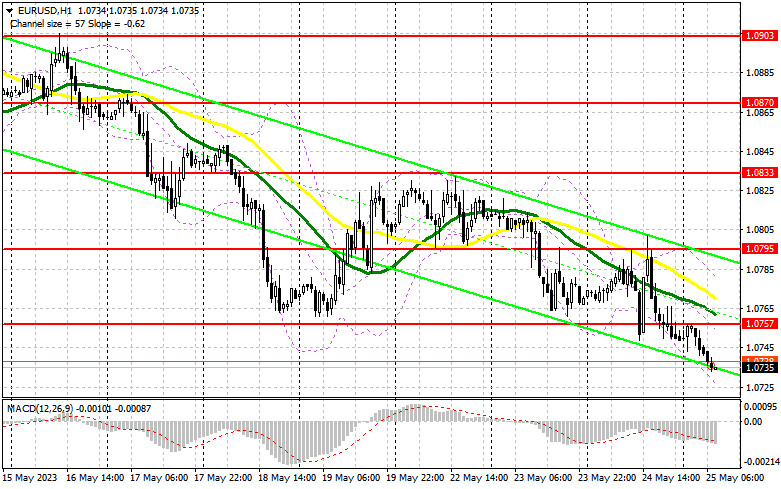

SInce I expect the pair to remain under pressure, I plan to act only after a decline and false breakout around the new monthly low of 1.0715. That will confirm the presence of traders who are willing to push the euro higher against the bearish trend, providing a buy signal with the goal of rising towards the nearest resistance level of 1.0757, where the moving averages favor the bears. A breakout and a downward retest, after good German reports and negotiations to raise the U.S. debt limit, would strengthen the demand for the euro and produce a buy signal, with a new high near 1.0795 as the target. The most distant target remains in the 1.0833 area, where I will take profit.

If EUR/USD declines and there are no bulls at 1.0715, which is more likely in such a bear market, we can expect a trend development. If that happens, I recommend postponing long positions until the price hits the next support level at 1.0674. Buying will only be considered on a false breakout there. Opening long positions on EUR/USD immediately on a rebound can be done from 1.0634, keeping in mind an intraday correction of 30-35 pips.

For short positions on EUR/USD:

The bears are still holding the upper hand in the market. Protection of the nearest resistance level of 1.0757 remains a priority and a suitable scenario for increasing short positions with a view to a further downtrend. A false breakout at this mark will produce a sell signal capable of pushing the pair to another low for this month at 1.0715. A sustained move below this range, along with an upward retest, could pave the way towards 1.0674. The most distant target is still the 1.0634 low, where I will take profit.

If EUR/USD moves higher during the European session and the bears remain idle at 1.0757, it is possible to count on a correction. In such a scenario, I will open short positions only around 1.0795. Going short will only be considered on a false breakout there. I will open short positions immediately if EUR/USD bounces off the high at 1.0833, targeting a downward correction of 30-35 pips.

COT report:

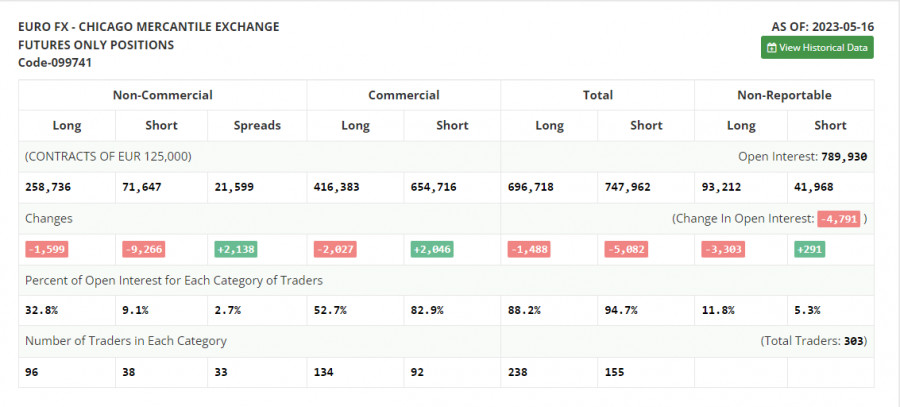

The COT report for May 16 showed that both long and short positions declined, although the latter dropped more strongly. The downward correction of the euro that we observed last week remains a good opportunity to increase long positions. However, until the US debt ceiling issue is resolved, it is unlikely that we will see significant demand for risk assets. Traders are even ignoring statements from Federal Reserve officials, who unanimously emphasize that the committee will pause the rate hike cycle at the upcoming meeting, which is a bullish signal for the euro. So, we need to wait a bit for bulls to return to the market once the debt ceiling issue is raised. According to the COT report, non-commercial long positions decreased by only 1,599 to 258,736, while non-commercial short positions decreased by 9,266 to 71,647. The overall non-commercial net position increased to 187,089 from 179,422 at the end of the week. The weekly closing price decreased to 1.0889 from 1.0992.

Indicator signals:

Moving Averages

Trading is carried out below the 30 and 50 daily moving averages. It indicates a further decline in the instrument.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair falls, the lower band of the indicator at 1.0735 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.