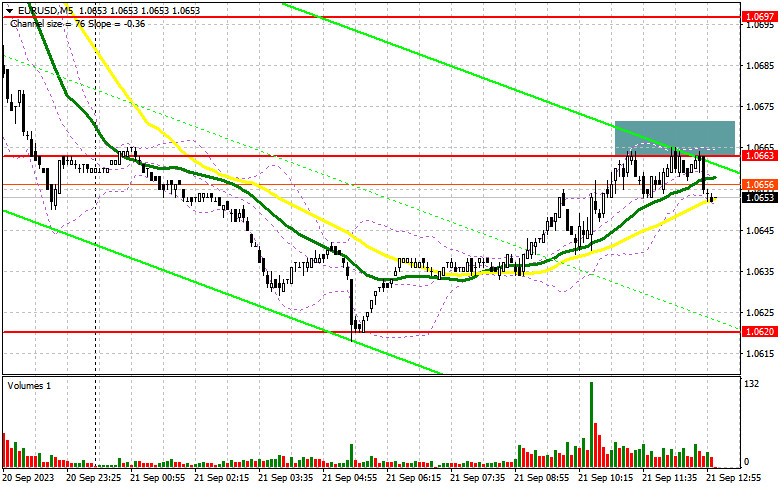

In my morning forecast, I emphasized the level of 1.0663 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout became the reason for selling the euro. However, there has been no significant downward movement by the time of writing this article. In any case, as long as trading remains below 1.0663, there are chances for a further decline in the EUR/USD pair according to the trend. The technical picture for the second half of the day remains unchanged.

To open long positions on EUR/USD, the following is required:

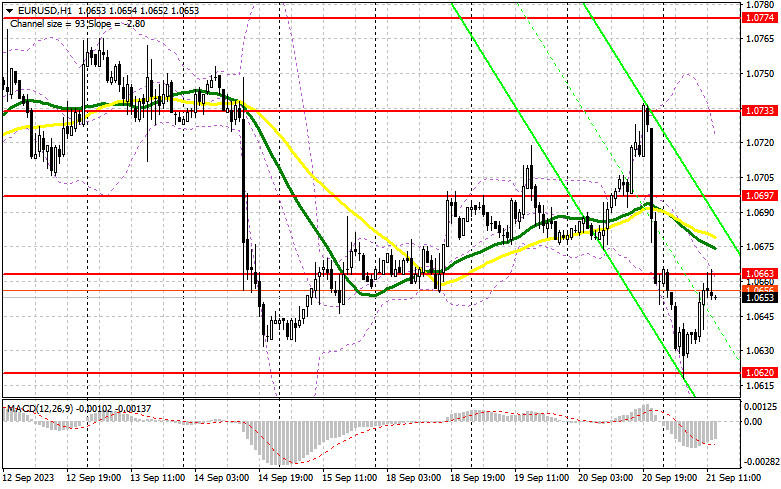

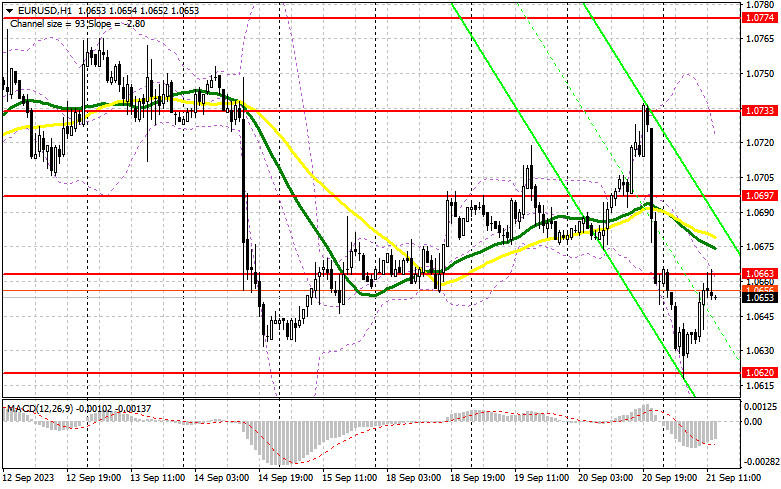

During the American session, we expect some interesting data related to the US labor market, highlighted by Federal Reserve representatives yesterday. If the number of initial jobless claims in the US decreases again, pressure on the pair will likely return, leading to another drop in EUR/USD along the trend. Good sales data in the secondary housing market and an increase in the Federal Reserve's Philadelphia Manufacturing Index are reasons to buy the US dollar and sell the euro. Therefore, I will take time to enter long positions against the bearish market. I plan to act only on a decline towards the nearest support at 1.0620. The formation of a false breakout there will provide a good entry point for long positions, expecting another upward correction in the pair to retest the resistance at 1.0663. A breakthrough and testing of this range from top to bottom against the backdrop of weak US data, especially in the labor market, will boost demand for the euro, giving a chance for a jump to 1.0697, just below the moving averages that favor sellers. The ultimate goal will be the area around 1.0733, where I will take profit. In the case of a decline in EUR/USD during the second half of the day and a lack of activity at 1.0620, the bearish trend will continue developing. In such a scenario, only the formation of a false breakout around 1.0590 will signal an entry into the market. I will open long positions on a bounce from 1.0554 with the aim of an upward correction of 30-35 points within the day.

To open short positions on EUR/USD, the following is required:

Sellers have managed to control the market since the morning, and they continue to do so. If trading is below 1.0663, it is possible to bet on the euro's decline. Of course, it would be nice to get another false breakout at this level, which, together with strong US data, will provide another good entry point for selling and confirm the presence of large players in the market. The target is the monthly minimum at 1.0620. Only after a breakthrough and consolidation below this range, as well as a reverse test from bottom to top, do I expect to get another selling signal with a target of 1.0590 - a new monthly minimum, where I expect the presence of larger buyers. The ultimate goal will be the area around 1.0554, where I will take profit. In the event of an upward movement in EUR/USD during the American session and the absence of bears at 1.0663, buyers will have a good chance of recovery. In this case, I will postpone short positions until the new resistance at 1.0697. You can also sell there, but only after an unsuccessful consolidation. I will open short positions on a rebound from 1.0733 with the aim of a downward correction of 30-35 points.

In the COT report (Commitment of Traders) as of September 12th, there was a sharp reduction in long positions and a slight decrease in short positions. Very serious negative changes in activity in the Eurozone and a downward revision of GDP for the second quarter did not prevent the European Central Bank from raising interest rates again. As you understand, this will not lead to anything good soon, which caused such a sharp decline in the European currency. In the near future, we will have a meeting of the Federal Reserve, and if the committee also decides to raise rates, the euro will collapse even further against the dollar. Therefore, I advise against rushing to buy in the current conditions. The COT report noted that non-commercial long positions decreased by 23,356 to 212,376, while short non-commercial positions decreased by only 205 to 99,296. As a result, the spread between long and short positions increased by 6,589. The closing price decreased to 1.0736 from 1.0728, indicating a bearish market.

Indicator signals:

Moving Averages

Trading is taking place below the 30 and 50-day moving averages, indicating further decline in the pair.

Note: The author considers the period and prices of the moving averages on the hourly chart (H1), which differ from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

In the case of an uptrend, the upper boundary of the indicator at around 1.0663 will act as resistance.

Description of Indicators

- Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence – convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.