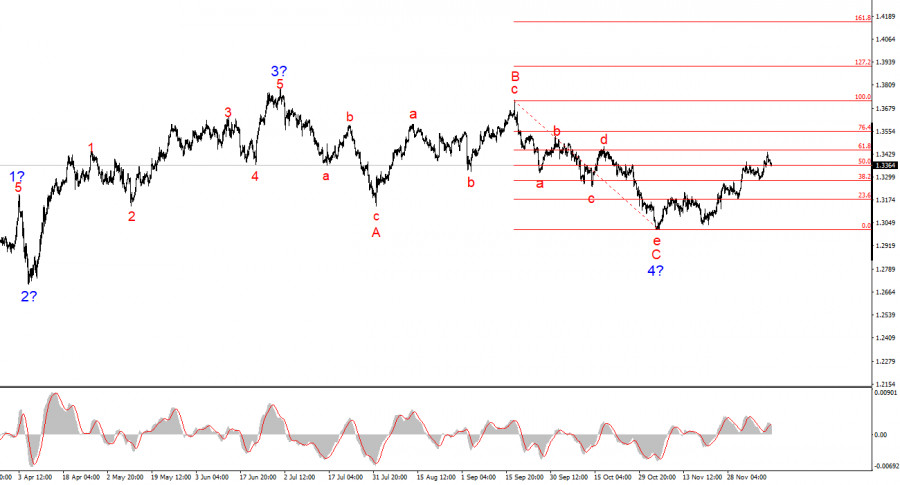

For the GBP/USD pair, the wave pattern continues to indicate the formation of an upward trend segment (bottom chart), but in recent weeks it has taken on a complex and extended form (top chart). The trend segment that began on July 1 can be considered wave 4—or any large corrective wave—since it has a corrective rather than impulsive internal wave structure. The same applies to its internal subwaves.

The downward wave structure that began on September 17 has taken the form of a five-wave sequence a–b–c–d–e and should be considered complete. If this is indeed the case, the instrument is now in the phase of forming a new upward wave sequence. Naturally, any wave structure can complicate at any moment and extend further. Even the presumed wave 4, which has been forming for five months, could take on a five-wave form, in which case we would continue observing a correction for several more months. However, at the moment there is a strong chance that an upward wave sequence is unfolding. If that is the case, the first two waves of this segment have already been completed, and we are now observing the construction of wave 3 or c.

The upcoming BoE meeting and labor-market statistics are equally dangerous for both the pound and the dollar. The GBP/USD rate declined by 20 basis points during Friday. However, this week can already be set aside, because ahead lies another one—no less important both for the pound and for the dollar.

I may be repeating myself, but I try to focus on only the most important news and events because they either correlate with the wave pattern or do not. That is why I was barely interested in today's GDP and industrial production reports from the UK. Consider how important these reports truly were for the market if by the middle of the U.S. session the total movement of GBP/USD (over 18 hours) amounted to just 40 points. And it is also difficult to say which report was more important. At first glance, GDP carries more weight, but today we received only a one-month reading—one that turned out weaker than market expectations. At the same time, the less significant industrial production report delivered a higher-than-expected result, which likely softened the negative market reaction.

Returning to next week: If this week demand for the U.S. currency fell amid the Fed's monetary policy easing, then next week it may decline due to the Bank of England's expected policy easing. Recall that the probability of a rate cut in the UK is also very high.

However, the U.S. will publish reports next week that I personally consider even more important than the recent Fed meeting. The FOMC acted blindly on Wednesday and provided the most neutral information possible, given the lack of statistical data. But next week, updated figures on labor markets, unemployment, and inflation will be released—data that will undoubtedly influence the Fed's decisions at the start of 2026. Therefore, the GBP/USD pair may come under pressure even if such pressure contradicts the wave pattern.

Conclusions

The wave pattern of GBP/USD has changed. We are still dealing with an upward impulsive trend segment, but its internal structure has become more complex. The downward corrective a–b–c–d–e structure within wave C of wave 4 appears fully complete. If this is indeed the case, I expect the main uptrend to resume with initial targets near the 1.38 and 1.40 levels.

In the short term, I expected the construction of wave 3 or c with targets located near 1.3280 and 1.3360, which correspond to 76.4% and 61.8% Fibonacci retracement levels. These targets have now been reached. Wave 3 or c may continue to develop, and the current wave sequence is beginning to look impulsive. Consequently, further strengthening of the pair is possible.

The higher-degree wave pattern looks nearly perfect, even though wave 4 slightly exceeded the high of wave 1. But let me remind you that perfect wave patterns exist only in textbooks—real markets are much more complex. At this time, I see no grounds for considering alternative scenarios to the upward trend segment.

Key Principles of My Analysis

- Wave structures should be simple and clear. Complex structures are hard to trade and often lead to changes.

- If there is no confidence in what is happening in the market, it is better to stay out of it.

- Absolute certainty about market direction does not exist and cannot exist. Always use protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.